Best Term Insurance plan In India 2024 – Full Details

Best Term Insurance plan In India 2024 – Life is precious, and safety is also essential.

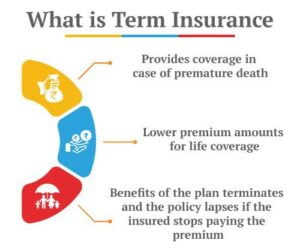

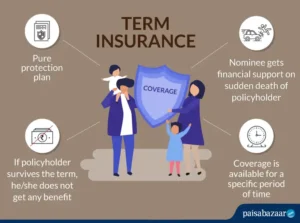

Are you worried about securing the future of your loved ones? Do you want their financial needs to be met even in your absence? If yes, then a Term Insurance plan might be the most suitable option for you. Term Insurance is a safety net that provides financial security to your dependents in the event of your untimely death.

This plan obligates you to pay a certain amount (“sum assured”) for a specific period (“policy term”).

If you die during the policy term, the sum assured is paid to your nominated beneficiaries, which they can use to pay off your liabilities, cover your children’s education expenses, or maintain their standard of living.

Best Term Insurance Plan in India in 2024

When choosing the best term insurance plan, several factors should be considered, including:

- Your Age: The younger you are, the lower the premium.

- Your Health: If you are healthy, you will have to pay a lower premium.

- Your Insurance Coverage: You need adequate insurance coverage according to your needs.

- Premium: It is important to be able to pay the premium according to your capacity.

- Policy Features: Different policies offer different features, such as riders, claim settlement ratio, tax benefits, etc.

Here are the best term insurance plans:

- HDFC Life Click 2 Protect Super: This plan offers affordable premium rates and comprehensive coverage.

- ICICI Prudential iProtect Smart: This plan comes with various rider options and flexibility.

- SBI Smart Shield: This plan is known for affordable premiums and a good claim settlement ratio.

- Kotak e-Term Plan: This plan is easy to purchase online and includes many features.

- Tata AIA Sampoorna Raksha Supreme: This plan provides extensive coverage and a wide range of rider options.

Best Term Insurance plan In India 2024

Before buying a term insurance plan:

- Assess your needs and budget. Compare different plans.

Choose a reputable insurance company.

Read all the terms and conditions of the policy carefully.

Inform your loved ones about the policy.

A term insurance plan can provide important financial security for your family.

Life is full of uncertainties.

Thinking about the future security of your family is a responsibility every responsible person should undertake.

If you were to suddenly leave this world, what would be the situation of your family?

Would they be able to meet their financial needs in your absence?

This is where a term insurance plan can help you.

A term insurance plan is a protective shield that provides financial security to your dependents in the event of your untimely demise.

Take the time to choose the right plan for your needs.

This information is for general informational purposes only and should not be considered as financial advice.

Why should you seek advice from a financial advisor before buying a term insurance plan?

Buying a term insurance plan is an important financial decision that can impact your and your family’s future.

With various types of plans, coverage options, and premium rates, choosing the right plan can be confusing.

It is advised to consult a financial advisor before purchasing a term insurance plan to understand

| No. | Insurance Company | Plan Name | Maximum Cover Amount | Minimum Premium | Notes |

|---|---|---|---|---|---|

| 1 | LIC | Amrit | ₹2 Crore | ₹5000 per year | Major endorsements and primary motivation |

| 2 | HDFC Life | Saamarth | ₹5 Crore | ₹6000 per year | Online and offline application process |

| 3 | ICICI Pru | iProtect Smart | ₹1 Crore | ₹4500 per year | Availability of riders and add-ons |

| 4 | SBI Life | SBI Protect | ₹2 Crore | ₹5500 per year | Super survivor and increment options |

| 5 | Max Life | Online Term Plan Plus | ₹3 Crore | ₹5000 per year | Quick claims and non-medical options |

| 6 | Kotak Life | Advantage Aspire | ₹2 Crore | ₹4800 per year | In-built critical illness riders |

| 7 | Tata AIA | Public Protect Plus | ₹1 Crore | ₹4500 per year | Developed bonus and online selection process |

| 8 | Bharti AXA | Elite Plan | ₹5 Crore | ₹6000 per year | Flexible premium options |

| 9 | Reliance Nippon | Desire 2 Secure | ₹2 Crore | ₹5000 per year | Increment option and availability of riders |

| 10 | Bajaj Allianz | Easy Care Life Bar | ₹3 Crore | ₹5500 per year | Online process and buyback options |

1.Help in assessing your needs.

An experienced financial advisor can assist in assessing your personal circumstances, financial goals, and risk tolerance. They can evaluate how much financial support your family would need after your demise.(LINK)

2.Find an appropriate plan:

There are many term insurance plans available in the market, each with its own features, benefits, and limitations. A financial advisor can help you find the optimal plan that matches your needs and budget.

3.Compare plans:

Comparing different plans and understanding the differences between them can be challenging. A financial advisor can help you compare the key features, benefits, and premium rates of various plans.

4.Obtain better premium rates:

Financial advisors have strong relationships with insurance companies, which can help them secure better premium rates for you.

5.Help understand policies:

The language of term insurance policies can be complex. A financial advisor can help you understand the terms and exceptions of the Best Term Insurance plan policy so that you can ensure you are making the right decision.

6.Assistance in the claims process:

If you ever need to file a claim, a financial advisor can assist you through the process to ensure you receive compensation according to your rights.

In the ever-evolving landscape of financial planning, term insurance stands out as a crucial tool for securing one’s future. As we move into 2024, selecting the right term insurance plan in India requires a nuanced understanding of the available options and features. Term insurance provides a high level of coverage at an affordable premium, making it an essential component of any robust financial strategy. This article explores some of the best term insurance plans available in India for 2024 and answers common questions to help you make an informed decision.

Top Term Insurance Plans in India 2024

- LIC Tech Term Plan

- Key Features: The LIC Tech Term Plan is a popular choice due to its reliability and extensive coverage options. It offers flexible premium payment options and an option for riders like accidental death benefits.

- Sum Assured: Up to ₹50 crore.

- Premium Payment Terms: Single, Limited, or Regular.

- HDFC Life Click 2 Protect Life

- Key Features: This plan provides comprehensive protection with options for critical illness cover and accidental death benefit. It also includes a choice between a life cover with a lump sum payout or a combination of lump sum and income benefit.

- Sum Assured: Up to ₹10 crore.

- Premium Payment Terms: Regular, Limited, and Single.

- Max Life Smart Term Plan

- Key Features: Known for its flexibility and affordability, this plan offers coverage against critical illnesses and terminal illnesses. It provides options to customize coverage and add riders for enhanced protection.

- Sum Assured: Up to ₹100 crore.

- Premium Payment Terms: Regular, Limited, and Single.

- SBI Life eShield

- Key Features: The SBI Life eShield is recognized for its straightforward approach and affordability. It offers a range of coverage options and is particularly praised for its transparent policy terms.

- Sum Assured: Up to ₹50 crore.

- Premium Payment Terms: Regular and Limited.

- ICICI Prudential iProtect Smart

- Key Features: This plan combines affordability with comprehensive coverage. It includes options for critical illness cover and offers a choice between a lump sum payout or a combination of lump sum and monthly income.

- Sum Assured: Up to ₹100 crore.

- Premium Payment Terms: Regular, Limited, and Single.

Frequently Asked Questions (FAQs)

1. What is term insurance?

Term insurance is a type of life insurance that provides coverage for a specific period or ‘term.’ If the insured person passes away during this term, the nominee receives a death benefit. Term insurance is designed to provide financial protection at an affordable cost, making it a popular choice for individuals seeking high coverage with low premiums.

2. Why should I consider term insurance in 2024?

In 2024, term insurance remains a cost-effective way to ensure financial security for your family in case of your untimely demise. Modern plans offer a range of additional benefits, including critical illness coverage, accidental death benefits, and flexibility in premium payments. Investing in term insurance now can lock in lower premiums and secure comprehensive coverage for the future.

3. How do I choose the best term insurance plan?

When choosing a term insurance plan, consider the following factors:

- Coverage Amount: Ensure the sum assured meets your financial needs and those of your dependents.

- Premiums: Evaluate the affordability of premiums in relation to your budget.

- Policy Tenure: Choose a term that aligns with your long-term financial goals.

- Additional Benefits: Look for plans that offer riders or additional benefits like critical illness cover.

- Claim Settlement Ratio: Opt for insurers with a high claim settlement ratio to ensure reliability.

4. Can I add riders to my term insurance plan?

Yes, many term insurance plans allow you to add riders or supplementary benefits for an additional premium. Common riders include accidental death benefits, critical illness cover, and waiver of premium on disability. These riders can enhance your coverage and provide additional protection.

5. What happens if I outlive the term of my insurance policy?

If you outlive the term of your policy, the coverage will expire, and no benefits will be paid. Some plans offer a maturity benefit or return of premiums if you survive the term, but this option usually comes with higher premiums. It’s important to review the policy terms and consider your long-term needs when selecting a term insurance plan.

6. Is term insurance tax-deductible?

Yes, premiums paid towards term insurance policies are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the death benefit received by the nominee is tax-free under Section 10(10D), subject to certain conditions.

Conclusion

Selecting the best term insurance plan in India for 2024 involves evaluating various options based on coverage, affordability, and additional benefits. The LIC Tech Term Plan, HDFC Life Click 2 Protect Life, Max Life Smart Term Plan, SBI Life eShield, and ICICI Prudential iProtect Smart are among the top choices, each offering unique features to cater to different needs. By understanding the key features and benefits of these plans, and addressing common questions, you can make a well-informed decision to ensure financial security for your loved ones.

Read More:-HDFC Home loan in india